Could the crypto crash set Bitcoin up for its next major rally?

Bitcoin is recovering after one of its sharpest corrections this year, with on-chain data suggesting the recent crypto crash may have set the stage for a healthier rebound.

Summary

- Bitcoin’s open interest plunged by $12 billion during Friday’s crypto crash, marking one of the steepest leverage resets in recent history.

- Key on-chain metrics, including funding rates and the Stablecoin Supply Ratio, point to stabilizing sentiment and rising liquidity.

- Digital asset investment products saw US$3.17 billion in inflows last week, with BTC leading at US$2.67 billion, demonstrating continued investor confidence.

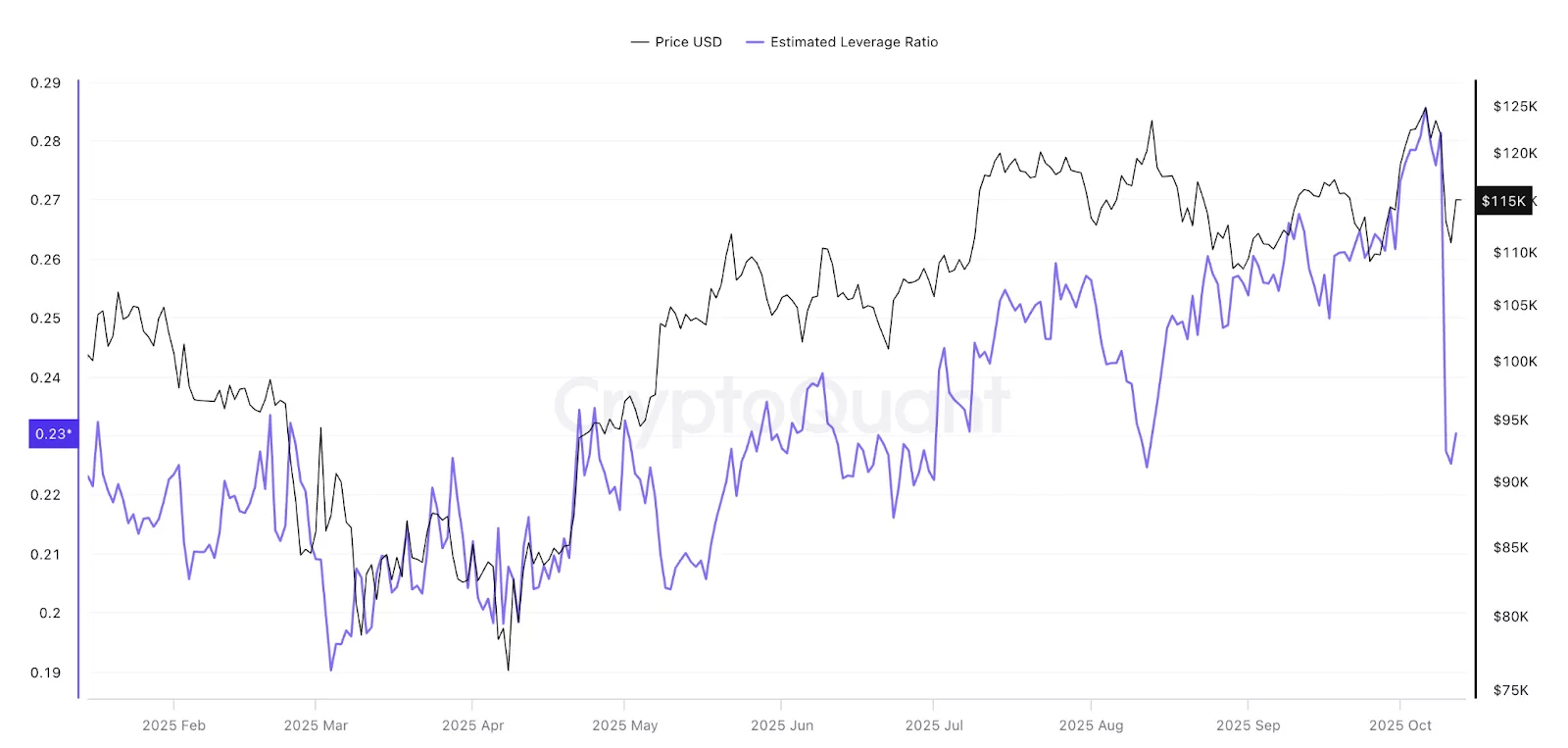

Bitcoin saw one of the biggest corrections in its history on Friday during the market-wide downturn. According to a recent CryptoQuant analysis, open interest suffered a $12 billion drop, plunging from $47 billion to $35 billion.

The correction pushed the asset’s price as low as $102,000, well below its recent peak above $126,000, before buyers stepped in over the weekend to fuel its recovery. At the time of writing, BTC (BTC) has rebounded to around $115,117, up more than 3% on the day.

While the sell-off was painful for many traders, it may have marked a much-needed reset that could pave the way for longer-term gains. The analysis noted that funding rates, which turned negative during Friday’s capitulation, have stabilized back to modestly positive levels, hinting that sentiment is normalizing as extreme bearish bets unwind.

Additionally, the BTC Estimated Leverage Ratio (ELR), which tracks how much leverage traders are using relative to Bitcoin held on exchanges, also fell sharply to its lowest point since August. This drop suggests that excessive leverage has been flushed out, reducing the risk of further liquidations and signaling a broad deleveraging across the derivatives markets.

Meanwhile, the indicator comparing Bitcoin’s market cap to that of stablecoins, the Stablecoin Supply Ratio (SSR), has declined to its lowest level since April. A lower SSR means more stablecoin liquidity is sitting on the sidelines, potentially ready to flow into the asset once confidence returns.

Historically, large-scale deleveraging events like this have often taken place just before major price recoveries, suggesting that the recent reset could be a positive signal for the months ahead. At the same time, strong capital flows into the market are adding weight to this outlook.

Bitcoin leads $3b inflows amid Black Friday crypto crash

Digital asset investment products saw US$3.17 billion in inflows last week, pushing year-to-date inflows to a record US$48.7 billion. This shows that, even amid volatility triggered by US-China tariff tensions, investors continue to allocate capital to the crypto market.

BTC led the inflows with US$2.67 billion, bringing YTD inflows to US$30.2 billion. Ethereum (ETH) followed with US$338 million, while SOL (SOL) and XRP (XRP) recorded smaller inflows of US$93.3 million and US$61.6 million, respectively. Friday’s drop saw limited outflows, suggesting that traders treated the correction as a buying opportunity rather than a trigger for panic selling.

Trading activity also hit record levels. Weekly volumes on digital asset ETPs reached US$53 billion, double the 2025 weekly average, while Friday’s daily volume hit US$15.3 billion, the highest single-day level on record.

The strong inflows and elevated trading volumes indicate that market participants remain confident in Bitcoin and the broader market despite short-term volatility. Combined with high liquidity, this may support the current rebound and set the stage for a more sustained recovery in the weeks ahead.

Source link