Ideal Finance Establishes Global FinTech Regulatory Innovation Lab in Silicon Valley and Partners with International Giants to Build Institutional-Level Compliant Digital Asset Custody System

Global FinTech Regulatory Innovation Lab: AI-Driven Next-Generation Compliance Technology Engine

The newly established Global RegTech Innovation Lab will be located in Silicon Valley, focusing on the research and development of regulatory technology (RegTech) solutions for global financial institutions and digital asset companies. The lab’s core areas of focus include:

– AI Compliance Auditing: Utilizing natural language processing and big data analysis to automatically generate real-time compliance audit reports for banks, payment institutions, and digital asset platforms.

– Real-Time Transaction Monitoring and Risk Control: Achieving millisecond-level identification and alerts for suspicious transactions through high-performance computing and the integration of on-chain and off-chain data.

– Standardization of Multi-Country Regulatory Reporting: Developing a unified global regulatory interface to support companies in meeting reporting requirements across multiple jurisdictions, including the U.S., EU, and Singapore.

– Compliance Tools for Digital Assets and Web3: Providing automated compliance adaptation solutions for stablecoins, security tokens (STOs), and decentralized finance (DeFi).

Partnering with International Asset Management Giants: Reshaping Institutional-Level Digital Asset Security and Compliance

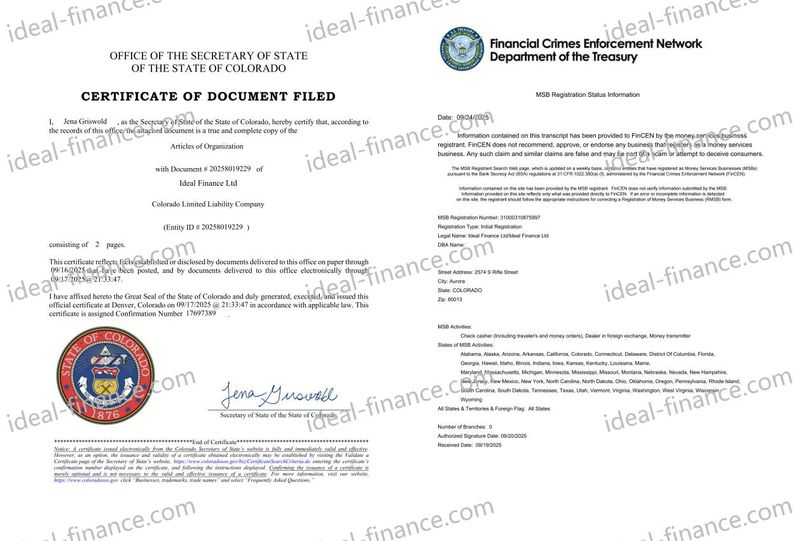

– Compliance Custody: Offering custody for digital assets and stablecoins that meet regulatory requirements based on the U.S. MSB and SEC regulatory framework.

– Secure Settlement: Enabling real-time settlement of stablecoins and security tokens (STOs), equipped with bank-grade security standards and a multi-layered protection system.

– Audit and Transparency: Including verifiable fund flow tracking and compliance audit reports to meet the compliance audit requirements of global regulatory agencies.

– Global Connectivity: Supporting cross-border business in major financial centers in North America, Europe, and Asia, facilitating the compliant global circulation of assets.

Leaders from several global asset management firms have expressed that this collaboration will address the long-standing compliance and security gaps faced by institutions in the digital asset market, building a trusted bridge between traditional finance and the Web3 world.

Compliance and Technology Dual Engines: Establishing a New Standard for Global Financial Infrastructure

The CEO of ideal-finance.com pointed out at the press conference: “The fintech industry is undergoing a transformative era of compliance and security. We have chosen to simultaneously increase our investment in regulatory technology innovation and institutional-grade infrastructure because only legally compliant technological innovation can truly drive global capital and user trust in the digital asset market.”

Thanks to its registered status in the U.S. and its obtained MSB registration and SEC approval, ideal-finance.com is able to provide regulated financial and digital asset services globally and has the capacity to legally acquire and integrate key technological resources. This not only places the company at the forefront of compliance technology but also lays a foundation of trust for its deep collaboration with top international financial institutions.

Looking Ahead

Media Contact

Contact: Allan R. McLeod

Company Name: Ideal Finance Ltd

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Source link