The Five Forgotten Commodities of Pure Proof-of-Work

The False Gatekeepers

Cryptocurrency was designed to bypass middlemen. Yet in 2025, exchanges have become the new gatekeepers — controlling which coins get liquidity, volume, and visibility. Their bias is obvious: they list heavily pre-mined projects, ICO tokens, and centralized Proof-of-Stake schemes because those projects pay listing fees, funnel insider supply, and reward the exchange with control.

In doing so, exchanges betray the original ethos of Bitcoin — neutral, permissionless, commodity-like money secured only by work.

The Lost Commodity Advantage

The greatest legal advantage in crypto today is being a commodity-class asset. Bitcoin already holds that status, and Litecoin ETFs validated the same lineage. Dogecoin, too, rides this wave. These coins — fair launched, mined, distributed without insider allocation — are not securities. They are digital commodities.

But exchanges have blurred this reality. Instead of elevating pure Proof-of-Work coins, they flood the market with pre-mined, ICO-issued, foundation-controlled tokens — assets that will never pass regulatory muster as commodities. In their chase for listing fees, they’ve poisoned the well.

The Five Forgotten Commodities

In this corruption, only a handful of pure PoW assets remain. They are not widely promoted by exchanges, because they don’t come with insider treasuries or centralized entities to cut deals.

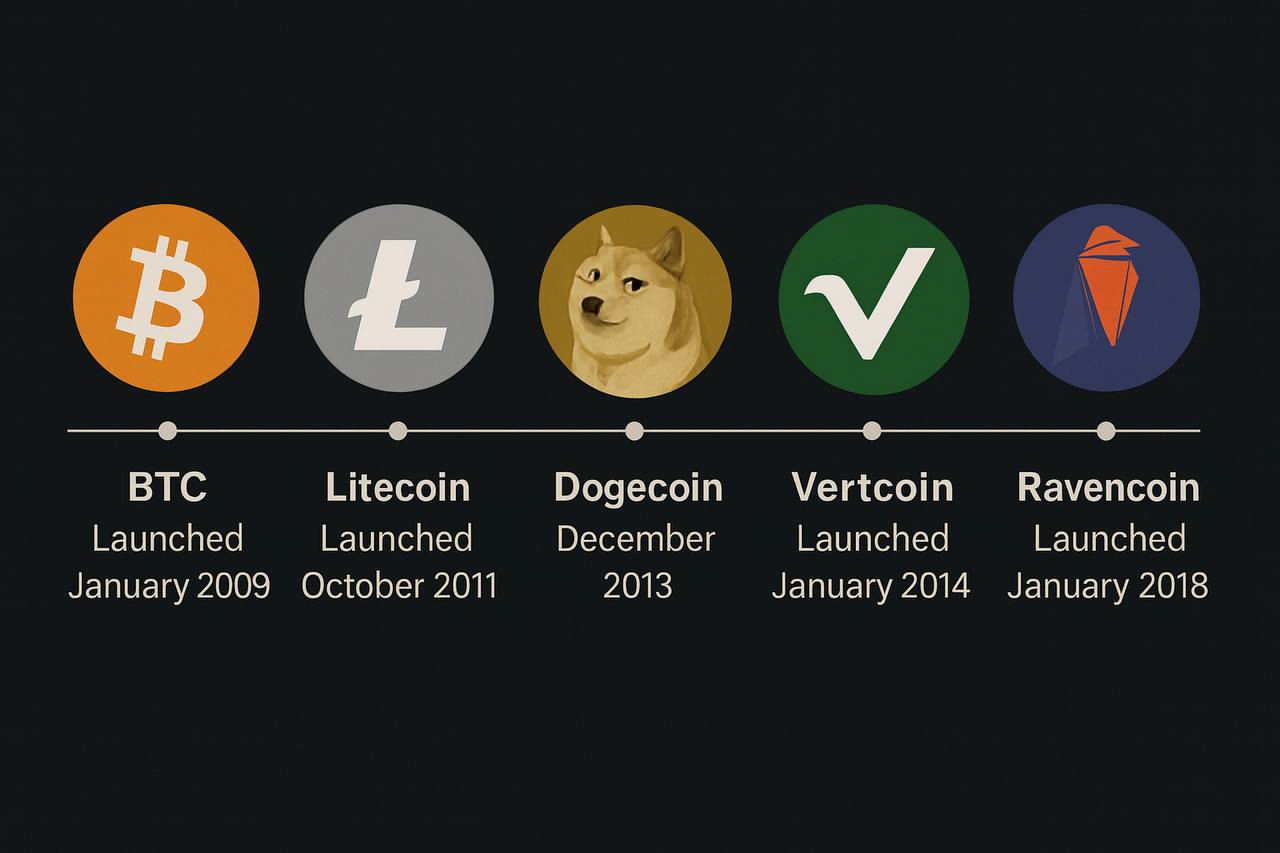

• Bitcoin (BTC) — Launched January 2009

• Litecoin (LTC) — Launched October 2011

• Dogecoin (DOGE) — Launched December 2013

• Vertcoin (VTC) — Launched January 2014

• Ravencoin (RVN) — Launched January 2018

These five are the true digital commodities. They launched fairly, with no ICO, no premine, no foundation dictating governance. And yet, exchanges consistently sideline them.

The Quiet Narrative

Exchanges want controllable tokens. Regulators want commodities. That contradiction is about to explode.

And when it does, the coins that survived without ICOs, pre-mines, or centralization will be the only safe harbors.

The irony? Exchanges have ignored them for years. Vertcoin, Ravencoin, even Litecoin before the ETFs — all sidelined because they couldn’t be milked for insider supply.

When the commodity narrative dominates, exchanges will scramble to list the very assets they once ignored — because they’ll have no other option if they want compliant, enduring liquidity.

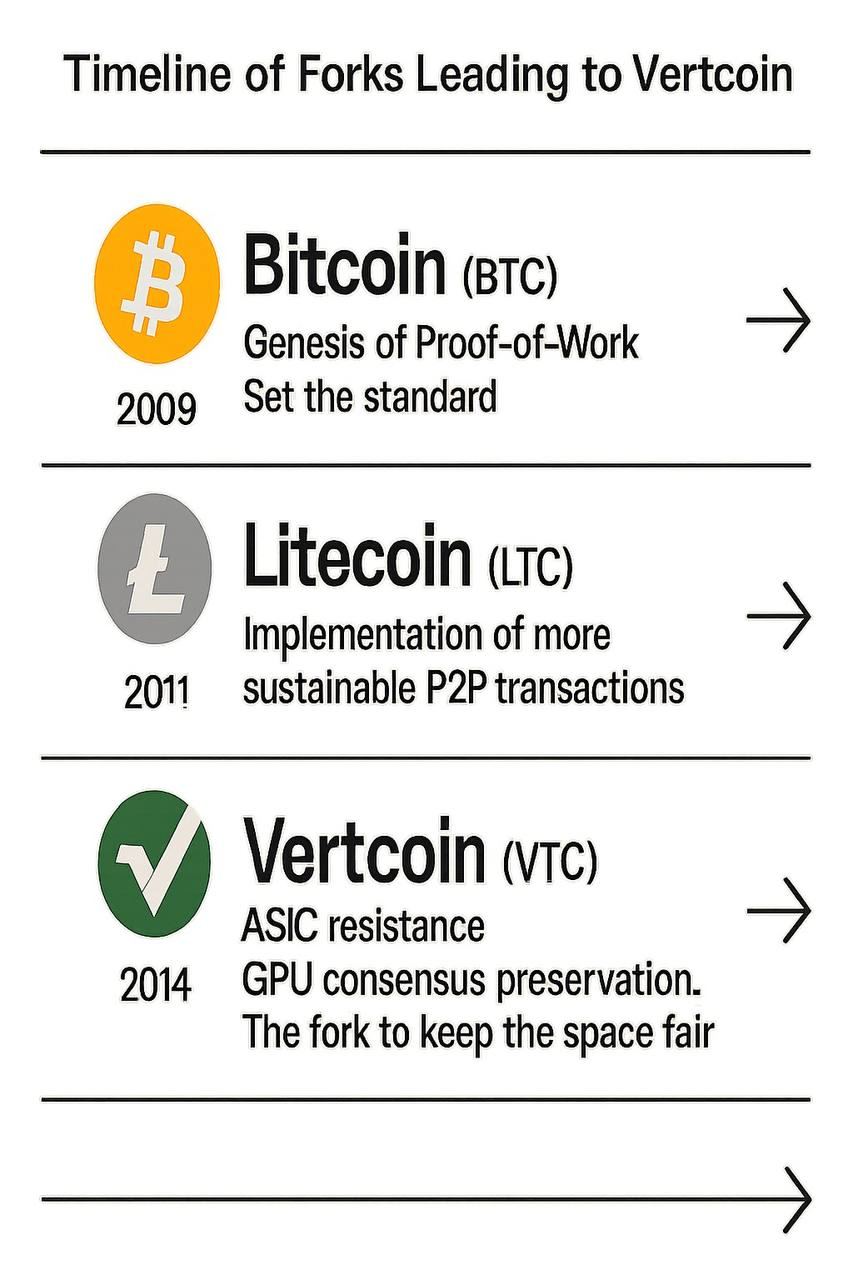

Why Vertcoin Stands Out

Vertcoin is unique. It was built to resist ASIC control, ensuring mining remains open to the people. It had no ICO, no premine, no insiders. It sits directly in Bitcoin’s commodity lineage. And it is one of the only remaining Proof-of-Work assets not yet embraced by the exchanges.

That silence is its advantage. Vertcoin isn’t diluted by foundation wars, staking centralization, or insider games. It is a people’s chain waiting for the inevitable moment when commodity purity becomes the only listing path left.

Source link