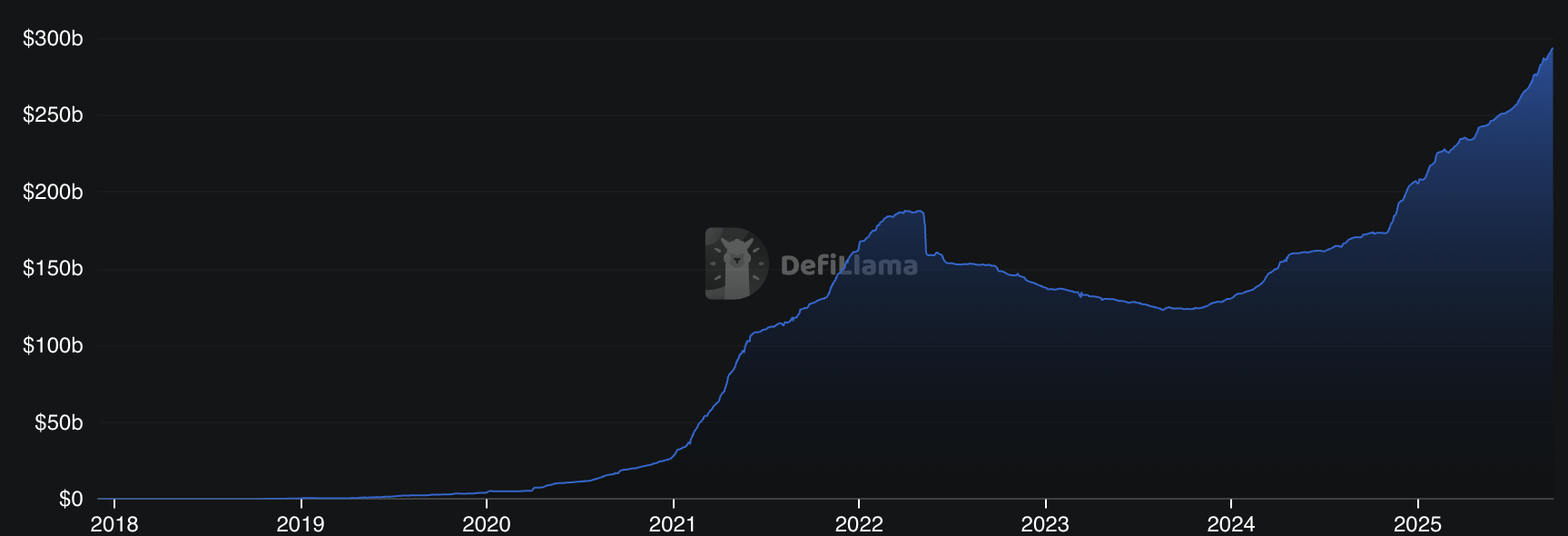

Stablecoins owe record market cap to regulatory tailwinds

On Wednesday, Sept. 24, the stablecoin market reached a historic milestone, reaching an all-time high of $294.56 billion, according to DeFiLlama.

Summary

- Stablecoin market cap reached an all-time high of $294.56 billion

- Tether’s USDT is still in the lead, but Circle’s USDC is catching up

- Favorable regulatory conditions, including the passage of the GENIUS Act, boosted demand

USDT remains the leading stablecoin in the market, with a $173 billion market capitalization, accounting for 58.7% of the total. In fact, its issuer, Tether, is reportedly targeting a $500 million valuation in a private placement, seeking $15 million to $20 million in new capital.

Circle’s USDC is quickly catching up with $14.4 billion in market cap, making it the fastest-growing stablecoin in the past few months. The company’s recent IPO has taken Wall Street by storm, with its stock price gaining over 120% on its first day of public trading.

Regulatory tailwinds boost stablecoin demand

Perhaps the most significant tailwind came from the White House

World Liberty Financial (WLF), co-founded by President Donald Trump’s sons, launched the USD1 stablecoin in March, backed by U.S. Treasuries, cash, and audited reserves.

The Trump family holds a major stake, raising conflict-of-interest concerns as the administration pushes crypto-friendly policies. For example, in May, UAE-based MGX pledged to use USD1 for a $2 billion investment in Binance, drawing criticism as a possible influence-peddling scheme.

Since then, stablecoins have benefited from crypto-friendly legislation. In July, Congress passed the GENIUS Act in the U.S., a piece of legislation that regulates stablecoin issuance, boosting demand from traditional institutions.

The EU has also taken significant steps in regulating stablecoins, with the passage of the MiCA regulatory framework. Most recently, on Sept. 18, the Bank of Italy called for clarity on stablecoins issued across borders.

Moreover, several governments worldwide have taken steps to create stablecoins in their own national currencies. A key motivation for these moves was the concern that USD-denominated stablecoins could come to dominate the growing stablecoin ecosystem.

Source link