Bitcoin’s Not Done Bleeding, $50k May Be Next, Warns Analyst

itcoin is at risk of deeper losses as risk appetite fades and macro pressure builds, according to Standard Chartered’s head of digital assets research Geoff Kendrick.

In a note reported on by Bloomberg, Kendrick said weaker U.S. economic momentum and reduced expectations for Federal Reserve rate cuts have weighed on crypto markets. He added that falling digital-asset ETF holdings have removed a key source of demand.

Kendrick warned bitcoin could drop to $50,000 and Ethereum could fall toward $1,400 before stabilizing later in the year. BTC trades near $67,869 after reaching a 16-month low of $60,008 last week.

Standard Chartered cut its year-end bitcoin forecast by a third, lowering its 2026 target to $100,000 from $150,000. The bank cited deteriorating macro conditions and the risk of further investor capitulation.

Bitcoin has already suffered a major correction, falling as much as 50% from its October 2025 record high at its worst close on Feb. 5. Standard Chartered estimates only half of BTC supply remains in profit, a sharp decline though less severe than in prior bear cycles.

The bank pointed to an unsupportive interest-rate backdrop as a key headwind.

Markets have pushed back expectations for Fed easing, with investors now looking for the first cut later in the year. Kendrick said uncertainty around future Fed leadership has added to caution.

ETF flows also remain a concern. Standard Chartered estimated bitcoin ETF holdings have dropped by almost 100,000 BTC from their October 2025 peak. With an average purchase price near $90,000, many ETF investors now hold unrealized losses, raising the chance of additional selling pressure.

Despite the near-term downgrade, the bank maintained a constructive longer-term outlook. Kendrick noted that on-chain usage data continues to improve and the current downturn has not triggered major platform failures, unlike the 2022 cycle that saw collapses such as Terra/Luna and FTX.

Standard Chartered continues downgrading Bitcoin

Back in December of last year, Standard Chartered halved its forecasts, seeing Bitcoin at $100,000 by end-2025 and $150,000 by end-2026, while keeping a $500,000 target pushed out to 2030. Bitcoin did not hit $100,000 by the end of 2025.

The bank cited fading corporate treasury demand and slowing ETF flows at the time. Geoffrey Kendrick said corporate accumulation has “run its course,” leaving ETF inflows as the main driver.

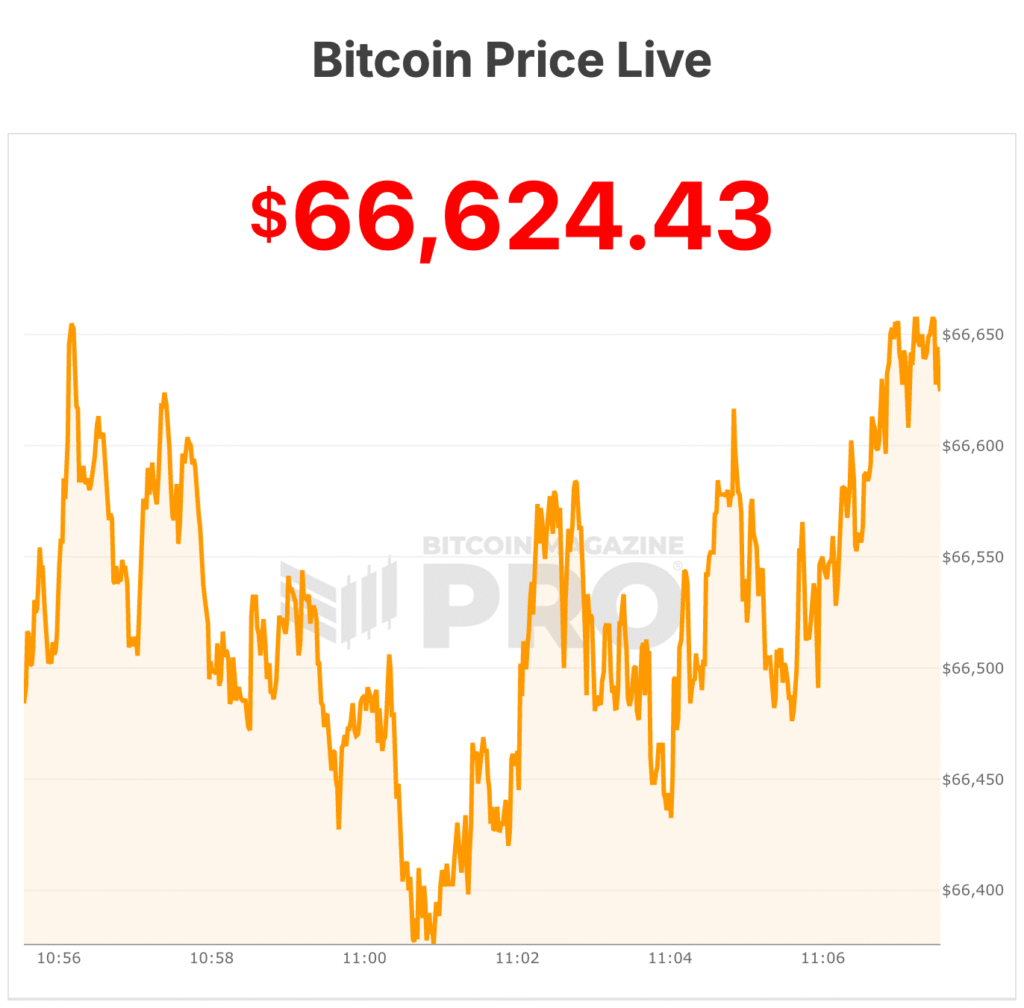

Bitcoin is currently trading near $67,000, per Bitcoin Magazine Pro data.

Source link