LEXINOVA Trading Center Completes U.S. FinCEN MSB Registration, Strengthening Its Compliance Framework

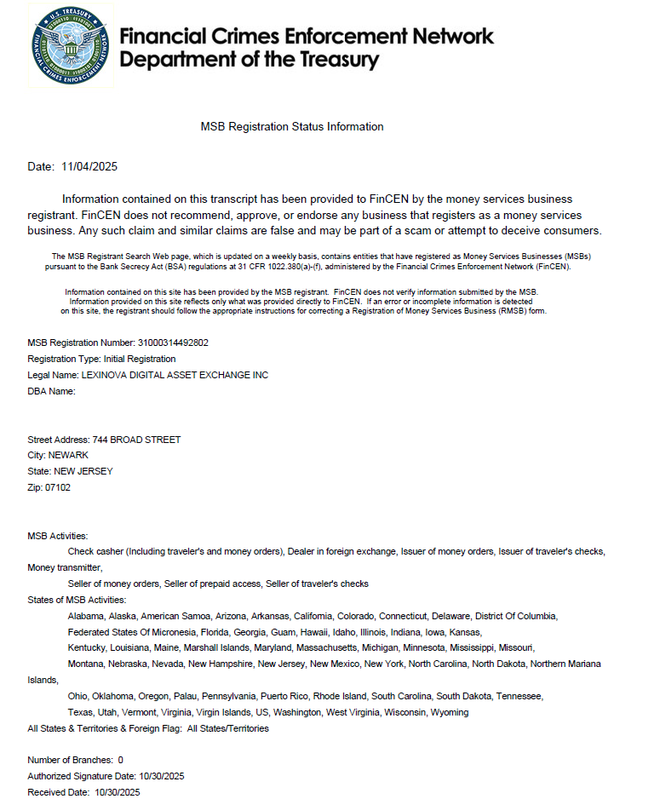

LEXINOVA Trading Center, a global digital asset trading platform, has completed its registration as a Money Services Business (MSB) with the U.S. Financial Crimes Enforcement Network (FinCEN). The development represents an important step in the platform’s broader compliance strategy and provides a regulatory foundation for its operations in the United States.

Completion of the MSB registration indicates that LEXINOVA Trading Center has established operational policies and control mechanisms aligned with U.S. regulatory expectations related to anti-money laundering (AML), customer due diligence (CDD), and transaction monitoring. The milestone supports the platform’s long-term objective of operating within recognized regulatory frameworks across multiple jurisdictions.

Compliance Preparation and Operational Alignment

In preparation for regulatory registration, LEXINOVA Trading Center undertook a series of internal system and process adjustments designed to enhance oversight, traceability, and governance. These measures included improvements to identity verification workflows, data management practices, and internal audit capabilities to support ongoing compliance requirements.

The platform’s compliance framework integrates risk assessment, monitoring, and reporting functions into its operational architecture, allowing regulatory controls to be applied consistently while maintaining system efficiency.

Adaptive Compliance Architecture Supporting Multi-Market Operations

LEXINOVA Trading Center employs a modular compliance design approach intended to accommodate varying regulatory requirements across different regions. By structuring compliance controls across identity, transaction, and data domains, the platform can adjust operational parameters in response to jurisdiction-specific rules while preserving user privacy and system stability.

This approach supports the platform’s ability to operate across regulated markets without relying on fragmented or market-specific system deployments.

Positioning for Institutional Participation and Long-Term Development

As global oversight of digital asset service providers continues to increase, regulatory alignment is becoming a key factor in platform credibility and sustainability. Completion of the U.S. MSB registration enhances LEXINOVA Trading Center’s legal clarity and operational readiness, supporting engagement with institutional participants and financial infrastructure partners.

The platform views compliance as a foundational component of long-term development and intends to continue aligning its technology and governance structures with evolving regulatory standards.

About LEXINOVA Trading Center

LEXINOVA Trading Center is a global digital asset trading platform focused on building secure, compliant, and resilient financial infrastructure. Through regulatory alignment, structured risk management, and institutionally oriented system design, the platform supports both retail and institutional participants seeking access to regulated digital asset trading environments across multiple jurisdictions.

Disclaimer:

The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Source link