Why did ETC, DOGE, and FTT move so differently after the Fed rate cut?

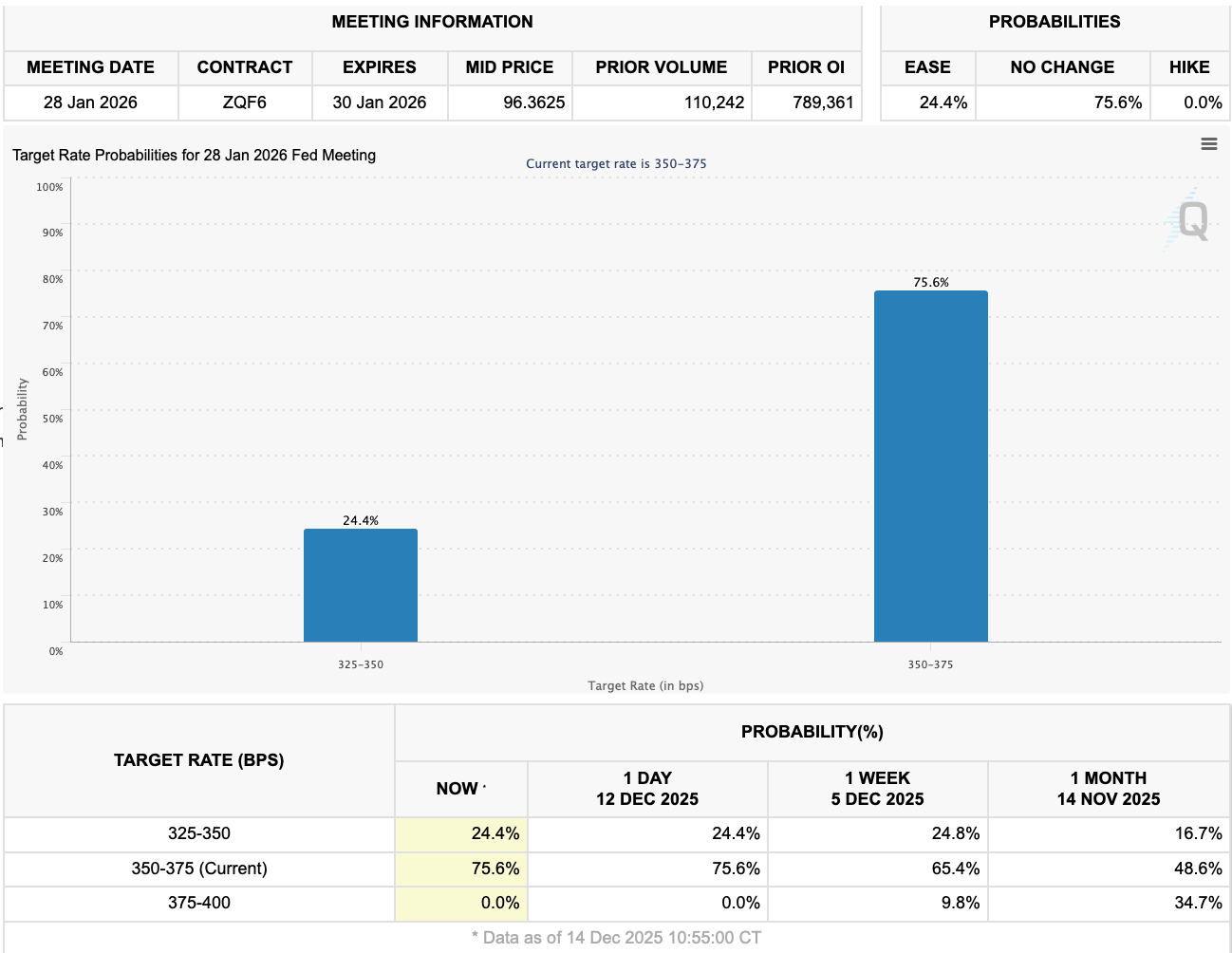

December did not deliver a clean “rate cuts equal rally” script. Policy loosened, but the market priced the next step as a pause. Probabilities for January 28, 2026 show 75.6% for no change at 350 to 375, 24.4% for an ease to 325 to 350, and 0% for a hike. That “hold is the base case” backdrop is why risk stayed selective instead of turning into a broad chase.

This is also where Ethereum matters. For most readers, the cleanest way to think about the market is this: Ethereum is the thermostat. When ETH to USD live price is consolidating around $3,100, it tends to dampen breakout energy elsewhere.

Search behavior even reflects it. A lot of “Ethereumeth” searches are simply people trying to locate the same baseline and decide whether conditions are warming up or cooling off.

Macro sets the backdrop. After that, each chart tells its own story: ETC price is about timing, DOGE price is about risk appetite, and FTT price is about legal headlines.

ETC price and the cost of waiting

As of December 15, ETC price is about $13.10, down -15.91% over 1 month.

The 1-month chart action lines up with a simple macro reality: risk-off months punish later catalysts. When policy headlines introduce uncertainty, markets usually demand immediate reasons to pay up.

For Ethereum Classic, the roadmap matters, but timing matters more.

The “Olympia” upgrade package has been positioned as a meaningful modernization step, bringing EIP-1559-style mechanics and a treasury and governance framework into the conversation. With ETC price hanging around low tens, the market is treating near-term moves as level-to-level trading rather than a clean trend.

Levels that keep showing up on the chart

- Support zone: roughly $12.80 to $13.00

- Resistance zone: roughly $14.00 to $14.50

The big takeaway is not that the roadmap is irrelevant. It is that macro pressure can keep a lid on price until the timeline feels close enough to matter.

DOGE price and the reality check after the headlines

As of today, DOGE price is at $0.13664, down -16.32% over 1 month.

The Doge cryptocurrency price tends to perform best when conditions reward risk and momentum.

In December, it was the opposite: Policy loosened, but the market mostly priced a hold at the next meeting, which left sentiment selective and rebounds harder to sustain.

A narrative shift has also been playing out. More attention has moved toward the Exchange Traded Fund (ETF) pipeline as a legitimacy catalyst.

The catch is that headlines do not always translate into real buying. A major media outlet reported roughly $2.16M in inflows tied to new DOGE ETF activity, which is not the kind of shock that forces a fast repricing.

So the Doge token price has mostly traded what it can actually see: liquidity conditions, sentiment, and nearby technical levels.

- Support: around $0.130

- Resistance: around $0.145 to $0.155, with heavier friction as you approach $0.170

In a month where uncertainty stayed high, DOGE price behaved like a sentiment gauge that is still trying to reset higher.

FTT price and why it trades like a headline sensor

As of December 15, the FTT price is about $0.5741, down -18.46% over the last 1 month.

Unlike ETC and DOGE, FTT crypto is not pricing a product cycle or a roadmap narrative in December. FTT moves on legal updates and distribution news. Quiet markets don’t always mean a quiet FTT token.

In the FTX bankruptcy process, the FTX Recovery Trust communicated major distribution milestones, including a $1.6B third distribution scheduled for September 30, 2025.

Separately, questions around restricted jurisdictions drove fresh volatility, with about $800M in claims linked to regions where distributions faced challenges before the request was withdrawn.

That’s the core reason FTT trades the way it does. It is not a clean technical structure story. It is a legal timeline story that periodically collides with liquidity.

- Support: around $0.50

- Resistance: roughly $0.60 to $0.61

Closing outlook into the end of 2025

December’s message was straightforward: easier policy did not guarantee a rally. The Fed cut rates on December 10, but markets stayed cautious, and with ETH live price consolidating near $3,100, smaller caps had no broad trend to ride. That kept the focus on levels, not lofty targets.

Into the final stretch of 2025, the setup remains range-first:

- ETC price is $13.1, with patience priced in until the catalyst timeline tightens.

- DOGE price is $0.13664, keeping Dogecoin price now near a key support zone as sentiment stays selective.

- FTT price is $0.5741, with FTT crypto still moving on bankruptcy headlines and payout mechanics, so FTT token swings can stay sharp even when markets are quiet.

How to buy crypto on Toobit

To buy crypto on Toobit, create an account, complete verification, and go to Buy Crypto. Choose a token, select a payment method, and confirm the purchase. Your assets will appear in Spot Account once the transaction settles.

Congratulations, you now know how to purchase crypto on Toobit!

About Toobit

To stay updated on the latest crypto news and happenings, make sure to follow Toobit. Toobit is a leading platform for crypto trading, offering a seamless experience for both beginners and experienced traders.

With a strong focus on futures trading and derivatives trading, Toobit allows users to maximize their potential profits through leverage trading.

Traders can explore a wide range of asset staking advantage of advanced tools and risk management features. With live coin updates, where you can get the latest news on BTC price, DOGE price, and even XLM price, Toobit does it all!

Create an account with Toobit today and find out how we offer A Bit More Than Crypto.

Source link