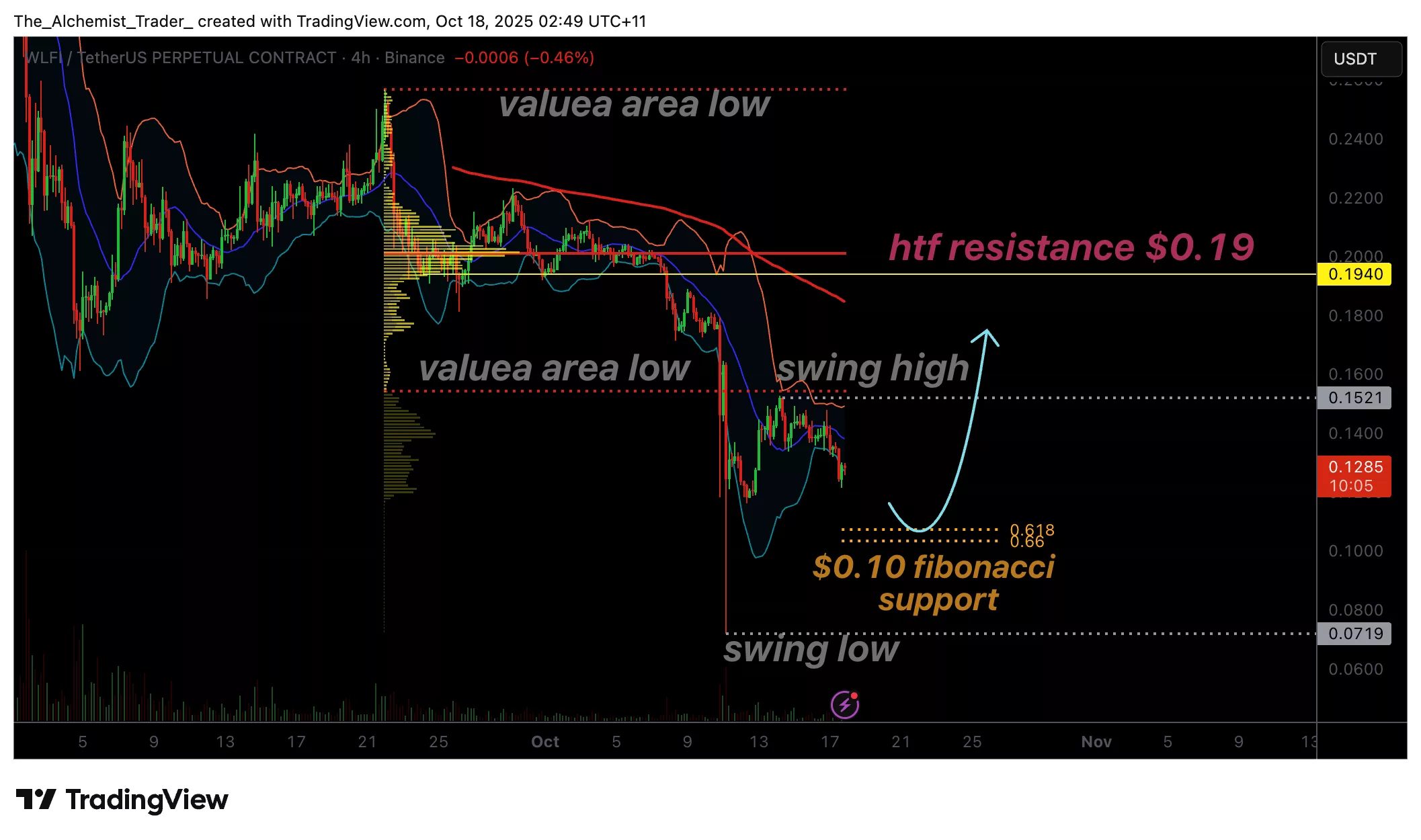

WLFI price eyes $0.10 as market structure remains bearish, why price can distribute further.

WLFI price continues in a bearish structure, with price action likely to extend lower toward the $0.10 support before any meaningful bullish rotation can develop.

Summary

- WLF continues forming lower highs and lower lows.

- $0.10 Fibonacci support is the next major target.

- Reclaim and hold above $0.10 could trigger a bounce toward $0.19.

World Liberty Financial (WLFI) remains entrenched in a bearish market structure, with consecutive lower highs and lower lows defining its current trajectory. Despite brief relief rallies, price action continues to favor sellers, indicating that the downtrend remains intact.

The next critical level to watch lies near $0.10, where the 0.618 Fibonacci retracement level aligns with a potential high time frame support zone.

WLFI price key technical points

- Bearish Market Structure: WLF continues to print lower highs and lower lows, confirming sustained downside momentum.

- Key Support Zone: The 0.618 Fibonacci level at $0.10 acts as the next major support and potential pivot point.

- Upside Objective: Holding the $0.10 region could enable a rebound toward the $0.19 high-timeframe resistance.

From a technical standpoint, the structure of World Liberty Financial remains clearly bearish. The asset has been unable to establish any convincing reversal pattern as the series of aggressive sell-offs persists. The market continues to distribute lower, forming successive lower highs while failing to reclaim any significant resistance levels on daily closes.

The $0.10 region, which aligns with the 0.618 Fibonacci retracement level, now stands as the next significant support. This area will likely determine whether a short-term base can form. For any reversal scenario to materialize, WLFI must test this level, attract sustained bullish volume inflows, and print a higher low on the lower time frames. Without this confirmation, the market structure will continue to lean bearish.

The broader outlook for WLFI suggests the market is still in the distribution phase, with momentum favoring the downside. The current price action sits in what can be described as “no-man’s-land,” between confirmed resistance and untested support. Until price reaches $0.10 and shows signs of stabilization, traders should expect continued volatility and potential weakness.

A structural break in the bearish pattern, supported by strong bullish engulfing candles and increasing volume, would be required to validate any shift in trend. If $0.10 holds and accumulation begins, a rotational move toward the $0.19 resistance becomes possible. However, failure to defend $0.10 would expose WLFI to deeper downside risk and potential continuation of the current downtrend.

What to expect in the coming price action

For now, World Liberty Financial remains bearish across all major time frames. Price action is expected to gravitate toward the $0.10 support zone as the next key test. Traders should watch for volume confirmation and structural stability at this level.

A successful defense of this zone could mark the start of an accumulation phase and potential recovery toward $0.19.

Source link