CoinMBA Launches the“Global Node Acceleration Plan,”Challenging Traditional Financial Settlement Systems

This program will establish infrastructure nodes across major global financial hubs to achieve higher network throughput, faster transaction confirmations, and lower cross-border settlement costs.

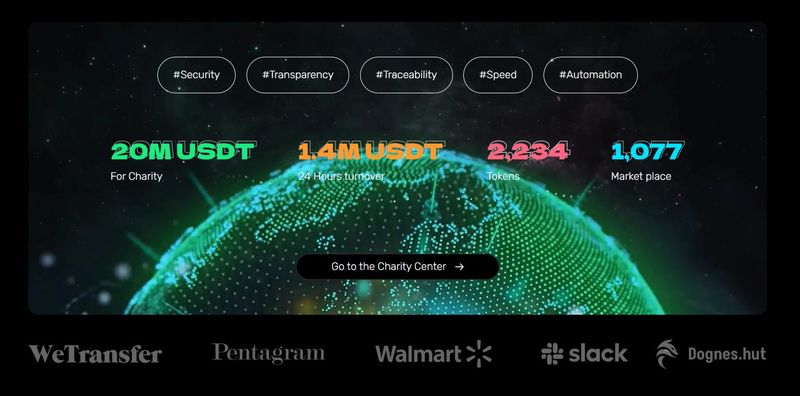

The company has long focused on cross-border settlement, RWA(Real World Asset)tokenization, institutional custody,and digital payment solutions, promoting the commercial adoption of blockchain technology in global financial infrastructure.

Global Node Deployment:Connecting East-West Financial Channels

According to the plan, CoinMBA will deploy operational nodes in more than 10 major global financial centers within the next 12 months.

The first batch of operational nodes has already launched in Singapore, Dubai, and London, while additional deployments in Zurich, Hong Kong, Seoul, and the Cayman Islands are currently underway.

Each node will feature the following functions:

Local Clearing and Settlement: Real-time multi-currency exchange support for USD, EUR, USDT, and USDC.

Cross-Chain Connectivity: Integration with major networks including BTC, ETH, SOL, BNB, and AVAX.

Smart Risk Control and Auditing: Regional regulatory compliance through transparent on-chain monitoring.

Technology-Driven Financial Innovation

CoinMBA’s competitive strength lies in its deep technological innovation.

The company’s self-developed high-performance matching engine supports over 1 million transactions per second (1M TPS) and adopts a dual-layer security structure combining MPC (Multi-Party Computation) and cold-hot wallet segregation, providing institutional-grade protection.

CoinMBA’s Chief Technology Officer commented: “The ultimate goal of blockchain finance is not speculation, but efficiency. Through our node network, we aim to achieve settlement speed and security that meet—or even surpass—traditional banking systems.”

Enterprise Clients and Institutional Ecosystem

CoinMBA has already attracted a broad range of institutional clients, including cross-border e-commerce platforms, supply chain finance companies, asset management firms, and payment providers, all participating in pilot operations.

Preliminary data shows that early node participants have achieved an average 68%reduction in settlement time,cutting transaction durations from several hours to just minutes—significantly improving corporate liquidity and capital turnover.

A senior operations executive at CoinMBA added: “The node network makes us more like a distributed financial operating system rather than a single trading platform. This marks a milestone in the infrastructure evolution of the digital economy.”

Currently, CoinMBA has established partnerships with several international clearing banks and payment service providers, delivering unified and compliant settlement channels for global enterprises and financial institutions.

Global Strategic Vision

The Global Node Acceleration Plan represents a cornerstone of CoinMBA”s long-term strategic roadmap. Over the next three years, the company aims to:

Establish over 30 operational nodes across major financial markets worldwide.

Launch the CoinMBA Settlement Cloud,opening clearing APIs to third-party financial institutions.

Enable multi-currency real-time settlements with synchronized compliance reporting.

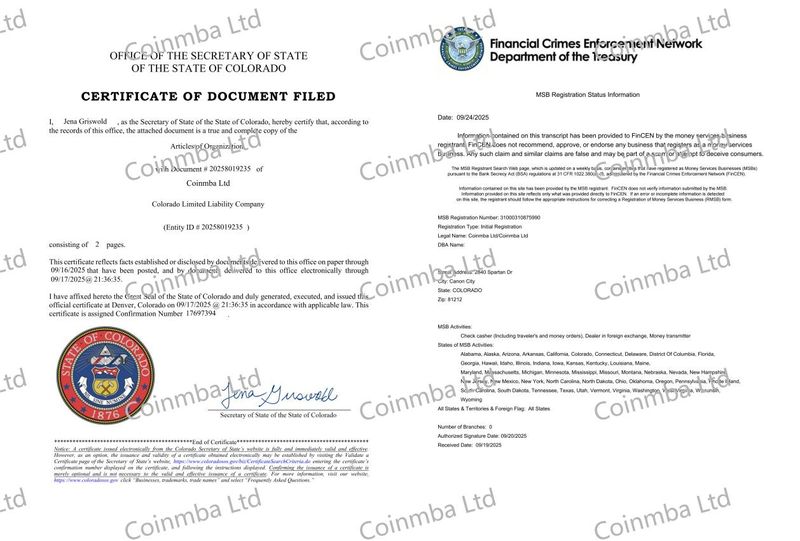

CoinMBA’s Global Vice President of Marketing noted: “Our mission is to make cross-border finance as frictionless as the internet. The MSB registration approval is just the beginning—we are rebuilding the foundational logic of future global finance.”

Conclusion

Industry observers believe that CoinMBA’s node strategy is more than just business expansion—it represents a structural transformation of digital financial infrastructure.

By integrating technology, compliance, and network architecture, CoinMBA is steadily evolving from a trading platform into the core engine for global cross-border settlement and digital asset clearing.

Media contact

Contact: Leonel K. Oleary

Company Name: Coinmba Ltd

Website: https://coinmba.com/main.html#/

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Source link