From USD1 Stablecoin Expansion to Strategic Public Company Integration

BitMart Research, the research arm of BitMart Exchange, has published a comprehensive report on World Liberty Financial (WLFI), analyzing the project’s evolving DeFi ecosystem, tokenomics, and its unprecedented $1.5 billion integration into NASDAQ-listed ALT5 Sigma. With the USD1 stablecoin at the core of its expansion strategy, WLFI has rapidly deployed lending, trading, and cross-chain utilities across Ethereum, BNB Chain, and Solana—while entering high-growth verticals like MemeFi, AI, and LSD protocols. The partnership with ALT5 Sigma, which mirrors MicroStrategy’s Bitcoin treasury model, marks a milestone in bridging crypto assets with traditional financial infrastructure. As WLFI gains traction across launchpads, RWA integrations, and staking ecosystems, this report explores how its stablecoin-driven architecture and strategic equity deals may redefine what institutional crypto adoption looks like in the next cycle.

I. Project Updates

Over the past year, World Liberty Financial (WLFI) has built a comprehensive DeFi ecosystem centered around the USD1 stablecoin, expanding into lending, trading, payments, Meme, LSD, AI, and even its own blockchain. Its strategy can be summarized in three phases:

-

Establish USD1’s foundational demand by deploying lending and trading scenarios across major blockchains such as BSC, Ethereum, and Solana.

-

Integrate USD1 into emerging sectors including Meme, stablecoins, and AI through investments and partnerships, thereby increasing usage frequency and user stickiness.

-

Secure long-term growth by strategically investing in and incubating early-stage projects, obtaining token rights, and driving further USD1 adoption.

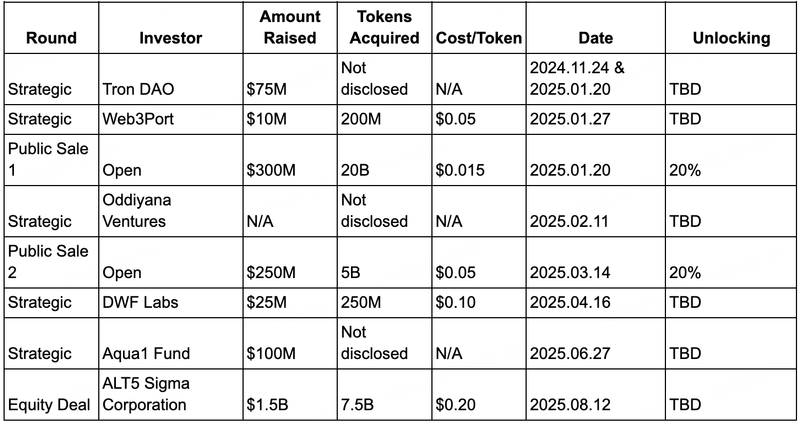

WLFI has completed four major fundraising rounds to date, with public sales priced at $0.015 and $0.05 per token. Strategic rounds attracted industry leaders such as Justin Sun (Tron DAO), DWF Labs, Aqua1 Fund, and Web3Port.

The most significant milestone was WLFI’s partnership with NASDAQ-listed ALT5 Sigma. In its latest S1 filing, ALT5 Sigma announced a $1.5 billion purchase of WLFI governance tokens, acquiring roughly 7.5% of total supply and receiving $750 million worth of tokens upfront. This move has been widely compared to MicroStrategy’s Bitcoin treasury strategy—embedding digital assets into a public company’s balance sheet, thereby elevating WLFI’s financial and regulatory legitimacy. The integration is further underscored by Eric Trump joining ALT5 Sigma’s board and WLFI CEO Zach Witkoff becoming Chairman of the company.

WLFI Investment Rounds Overview

II. Tokenomics and Market Performance

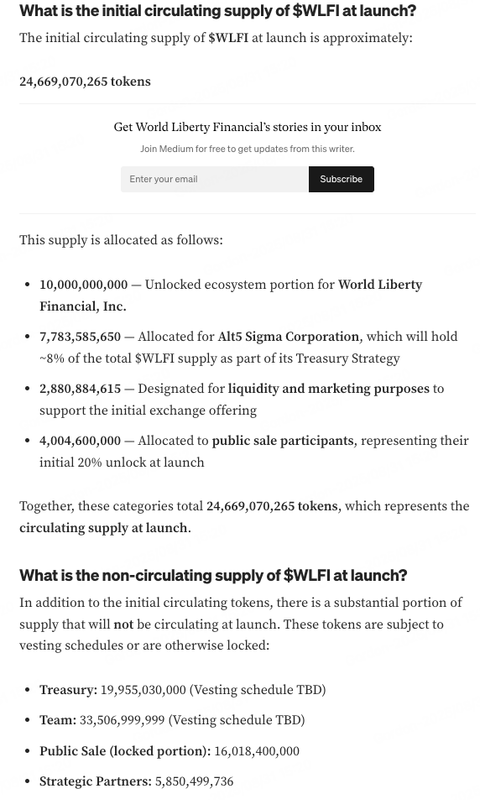

According to WLFI’s official blog, 24.67 billion tokens (24.6% of total supply) were unlocked at TGE, distributed as follows:

Notably, Alt5 Sigma’s allocation is considered part of its strategic reserves and is not expected to circulate at TGE. Similarly, ecosystem tokens are reportedly tied to the USD1 rewards program and are not immediately tradable. Therefore, the true circulating supply is estimated at 20% of public sales + liquidity/marketing.

Market Performance

WLFI launched on September 1st with limited initial momentum due to uncertainty over circulating supply. The token peaked at $0.32 before correcting to $0.225 by September 2nd. This equates to an initial circulating market cap of $5.71B and a fully diluted valuation (FDV) of $23.1B.

-

Public Sale 1 investors ($0.015 entry) saw paper gains of up to 20x.

-

Public Sale 2 participants ($0.05 entry) achieved several multiples at TGE.

-

Strategic investors such as Web3Port and DWF Labs also recorded strong returns.

-

ALT5 Sigma, entering at $0.20, is closest to the current market price and thus represents a psychological support zone. Historical pre-market trades suggest WLFI finds strong buying interest around $0.20, but a decisive break below this level could trigger broader market panic.

At present, WLFI’s price dynamics hinge on two main factors:

-

Unlock-driven sell pressure from public sale investors.

-

Potential token inflows from the ecosystem allocation or ALT5 Sigma’s strategic reserves.

If ecosystem tokens remain locked under the USD1 rewards plan, near-term sell pressure should remain manageable. However, should ALT5 Sigma or related funds decide to offload holdings, WLFI’s price stability could face substantial challenges.

III. Ecosystem Development

DeFi

-

Dolomite – A decentralized lending and margin trading protocol on Ethereum. USD1 has been integrated, with DOLO/USD1 as its primary market pair. Dolomite accounts for ~90% of USD1 lending liquidity on Ethereum. Its co-founder Corey Caplan also serves as WLFI’s CTO.

-

Lista DAO – A BSC-based lending and stablecoin platform. USD1 has been added as collateral, with lisUSD pairs live on PancakeSwap.

-

StakeStone – A cross-chain LSD liquidity protocol. Partners with WLFI to enable USD1-based staking yields and cross-chain liquidity.

Launchpads

-

Lets.Bonk – USD1’s official Solana launchpad, leveraging Meme culture to incubate new projects.

-

Buildon – A Meme project on BSC developing a USD1-exclusive launchpad.

-

Blockstreet – WLFI’s official launchpad, co-founded by Matthew Morgan, who is also CIO of ALT5 Sigma.

-

AOL – Meme token launched by WLFI advisor @cryptogle, with plans for America.fun launchpad.

RWA & Stablecoins

-

USD1 – WLFI’s USD stablecoin launched in March. Market cap surpassed $2.4B by September 1st, with >88.5% circulation on BNB Chain.

-

Chainlink (LINK) – WLFI leverages Chainlink CCIP for USD1 cross-chain interoperability.

-

Ethena (ENA) – Partnered in December to integrate with sUSDe.

-

Ondo Finance (ONDO) – USDY and OUSG added to USD1 reserves.

-

Falcon Finance – WLFI invested $10M; USD1 can be used for minting synthetic stablecoins.

-

Plume Network – WLFI integrated USD1 as reserve collateral for pUSD.

Other Projects

-

Vaulta (formerly EOS) – Rebranded as Web3 banking infra; WLFI invested $6M, USD1 integrated as settlement asset.

-

EGL1 – Meme project winning a WLFI trading contest.

-

Liberty – USD1-powered charity token on BNB Chain.

-

U – Meme project with WLFI’s public wallet holding >45% of supply.

-

Tagger – Decentralized AI data platform using USD1 for enterprise payments and rewards.

IV. Conclusion

WLFI’s current circulating supply is subject to two competing interpretations:

-

Optimistic scenario: Only ~6.88B tokens are effectively circulating, as Alt5’s reserves and ecosystem allocations are strategically locked. At ~$0.23, this equals a ~$1.58B circulating market cap.

-

Risk scenario: Both Alt5’s holdings and ecosystem allocations could eventually enter circulation, representing massive overhang and potential sell pressure.

Looking forward, WLFI’s development will continue to revolve around its USD1 ecosystem. Partnerships and new utilities—such as staking and lending—are expected to drive token adoption and valuation. Meanwhile, ALT5 Sigma’s $1.5B investment and governance integration firmly embed WLFI into the regulated financial narrative. Should WLFI successfully replicate MicroStrategy’s Bitcoin treasury model, it could gain significant traction in traditional finance and enhance its long-term financialization potential.

About BitMart

BitMart is a premier global digital asset trading platform with more than 12 million users worldwide. Consistently ranked among the top crypto exchanges on CoinGecko, BitMart offers over 1,700 trading pairs with competitive fees. Committed to continuous innovation and financial inclusivity, BitMart empowers users globally to trade seamlessly. Learn more about BitMart at Website, follow their X (Twitter), or join their Telegram for updates, news, and promotions. Download BitMart App to trade anytime, anywhere.

Risk Warning:

The information provided is for reference only and should not be considered a recommendation to buy, sell or hold any financial asset. All information is provided in good faith. However, we make no representations or warranties, express or implied, as to the accuracy, adequacy, validity, reliability, availability or completeness of such information.

All cryptocurrency investments (including returns) are highly speculative in nature and involve significant risk of loss. Past, hypothetical or simulated performance is not necessarily indicative of future results. The value of digital currencies may rise or fall, and there may be significant risks in buying, selling, holding or trading digital currencies. You should carefully consider whether trading or holding digital currencies is suitable for you based on your personal investment objectives, financial situation and risk tolerance. BitMart does not provide any investment, legal or tax advice.

Source link