SkyCrest Capital Fully Upgrades SAX-iCore System

SkyCrest Capital, a global leader in AI-driven asset management, today announced a major upgrade to its proprietary SAX-iCore (SkyAlpha X Institutional Core) system, officially elevating it into a cross-industry structured intelligence platform. Industry observers see this as a disruptive leap for AI technology in global capital markets and multi-industry resource allocation.

From Trading Engine to Strategic Core

Originally launched in 2021, SAX-iCore began as a high-performance intraday trading and multi-market quantitative execution system, capable of identifying high-frequency, verifiable structured trading opportunities in perpetual crypto contracts, U.S. equities, and ETF rotation strategies, enabling users to achieve sustainable returns in volatile markets.

With this upgrade, SAX-iCore has evolved from a “high-performance trading engine” into a cross-industry structured decision hub, now offering:

– Global multi-asset capital management & strategy rotation

– Real-time cross-market structural recognition & trend tracking

– Instant interpretation and quantitative mapping of international policy & macro events

– Corporate finance, supply chain, and operational structure optimization

– Automated legal and compliance audits (including cross-border business)

– Sentiment and signal capture from information sources, plus risk alerts

SkyCrest Capital’s CEO commented:

“SAX-iCore is no longer just a trader’s tool — it’s an intelligent nerve center for management teams, capital decision-makers, and policymakers. Its mission is to make global high-value decisions data-driven, rhythm-controlled, and execution-verifiable.”

SkyCrest’s Head of R&D noted:

“This kind of long-term, stable, institutional capital perfectly matches SAX-iCore’s structured capture capabilities. The system can identify signals at the earliest stages of global capital flows and automatically adjust asset allocations via its AI models.”

Institutional Access & Strategic Partnerships

For the first time, SAX-iCore will open institutional-grade API interfaces to qualified strategic partners, with the first wave including:

– Global investment banks & asset managers

– Cross-border settlement & payment platforms

– Energy and commodities trading enterprises

– High-tech manufacturing & supply chain management groups

SkyCrest aims to build a global AI decision collaboration network, providing partners with advanced structured solutions at critical points of capital flow, industrial deployment, and policy response.

IPO Plans & Market Attention

SkyCrest Capital also announced that SAX-iCore will go public in November 2025.

The news has sparked significant interest from both institutions and individual investors.

Currently, the institutional version of SAX-iCore has generated $500 million in cumulative revenue and has been adopted by several leading global financial institutions. The personal version will launch in November, with priority purchase rights granted to SkyCrest Capital’s advanced members.

Analysts believe this move will not only expand SAX-iCore’s market share but also foster a new interactive ecosystem between individual and institutional investors, accelerating the adoption of AI-driven asset management.

Data Security & Compliance Framework

Another highlight of the upgrade is full integration with SEC, FINRA, and multiple international financial regulators.

All trading suggestions, execution logs, and capital flows within the system are fully traceable and encrypted to meet jurisdictional regulatory standards.

SkyCrest’s Chief Compliance Officer stated:

“Our clients aren’t just chasing returns — they want safety, compliance, and sustainability.”

Global Expansion & Vision

SkyCrest Capital has established operational and R&D centers in New York, London, Singapore, and Dubai, with plans to complete strategic expansion into Asian and Middle Eastern markets by 2026.

Dr. Ethan Carter emphasized in an interview:

“We envision SAX-iCore as part of the world’s top decision platforms — not just operating on exchanges, but actively shaping decisions in boardrooms, international negotiations, and government planning offices.”

About SkyCrest Capital

Founded in 2020 and headquartered in Manhattan, New York, SkyCrest Capital specializes in AI-driven multi-asset management and global strategic investment. Its SAX-iCore system is renowned for high execution power and cross-industry structured analysis, serving high-net-worth individuals, family offices, multinational corporations, and government institutions.

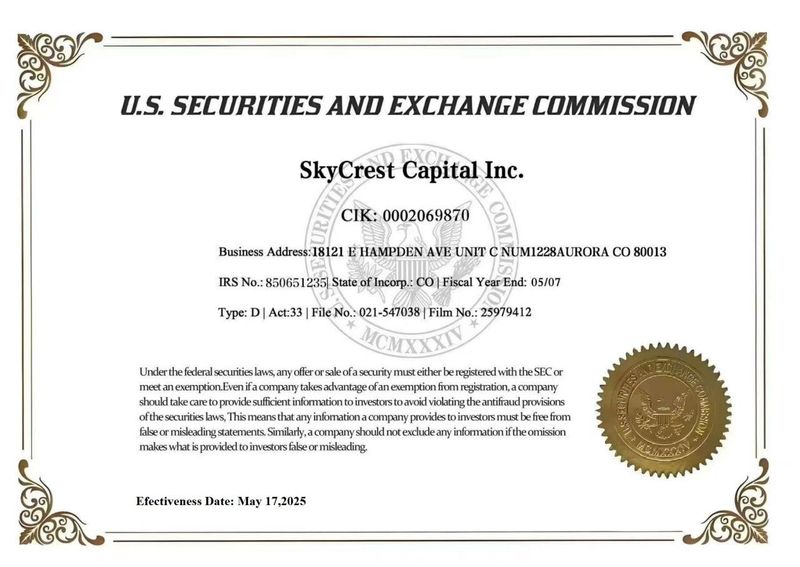

Registration & Compliance Information

SEC Filing: SkyCrest Capital Inc. registered with the U.S. Securities and Exchange Commission

CIK: 0002069870

Type: D | Act: 33 | File No.: 021-547038 | Film No.: 25979412

Address: 18121 E Hampden Ave, Unit C Num1228, Aurora, CO 80013, United States

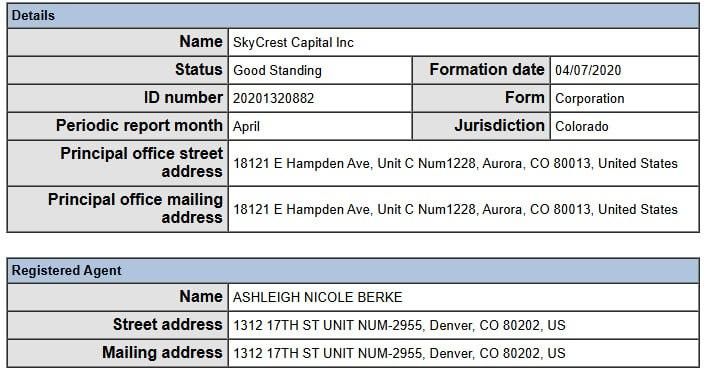

Corporate Registration:

State: Colorado

Date of Incorporation: April 7, 2020

Registration No.: 20201320882

Status: Good Standing

Registered Agent: Ashleigh Nicole Berke

Agent Address: 1312 17th St Unit Num-2955, Denver, CO 80202, United States

This registration and filing framework provides SkyCrest Capital with the legal and compliance foundation for global operations, laying the groundwork for SAX-iCore’s international applications and upcoming IPO.

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities.

Source link