BlackRock’s Bitcoin ETF Drives More Revenue Than Its S&P 500 Fund

BlackRock’s iShares Bitcoin Trust (IBIT) is now generating more annual fee revenue than its signature tracker of the S&P 500 Index, according to a Bloomberg report.

Despite being only 18 months old, the $75 billion iShares Bitcoin Trust ETF (IBIT) has drawn consistent inflows from investors. With a 0.25% fee, it now generates an estimated $187.2 million in annual revenue, surpassing the $187.1 million earned by BlackRock’s $624 billion S&P 500 ETF (IVV), which charges just 0.03%.

“IBIT overtaking IVV in annual fee revenue is reflective of both the surging investor demand for Bitcoin and the significant fee compression in core equity exposure,” said the President at NovaDius Wealth Management Nate Geraci. “Although spot Bitcoin ETFs are priced very competitively, IBIT is proof that investors are willing to pay up for exposures they view as truly additive to their portfolios.”

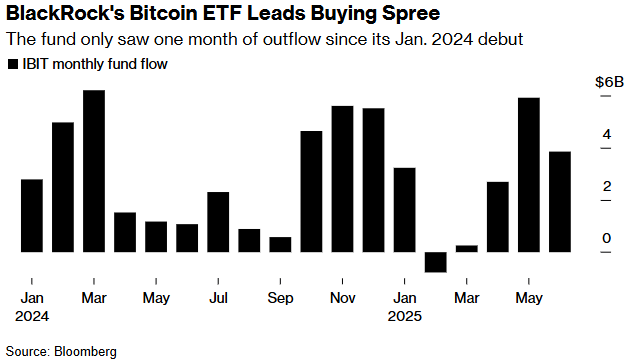

According to Bloomberg data, the surge has been driven by investor demand with IBIT attracting $52 billion of the $54 billion that has flowed into spot Bitcoin ETFs since they began trading in January 2024. It now holds over 55% of the category’s total assets and has seen outflows in only one month.

“It’s an indication of how much pent-up demand there was for investors to gain exposure to Bitcoin as part of their overall portfolio without having to open a separate account somewhere else,” said the co-founder of Bespoke Investment Group Paul Hickey. “It also illustrates the leadership of Bitcoin in the crypto space where it’s perceived utility as a store of value has essentially left the others in its dust.”

The 25-year-old IVV remains a traditional equity tracking, ranking as the third-largest ETF among more than 4,300 U.S. funds. The swift rise of Bitcoin ETFs reflects a regulatory shift that opened the door to broader adoption. This change has sparked a surge of capital from hedge funds, pensions and banks. As a result, IBIT now ranks among the top 20 most traded ETFs in the market.

Source link