Strategy Acquires $531.9 Million In Bitcoin, Now Holds 597,325 BTC

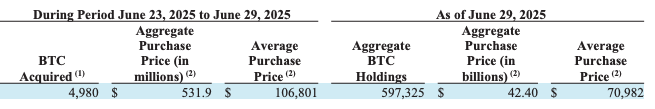

Strategy, formerly Microstrategy, has announced the acquisition of an additional 4,980 Bitcoin for approximately $531.9 million, according to a new SEC Form 8-K filed on June 30, 2025. The average purchase price was $106,801 per Bitcoin, inclusive of fees and expenses.

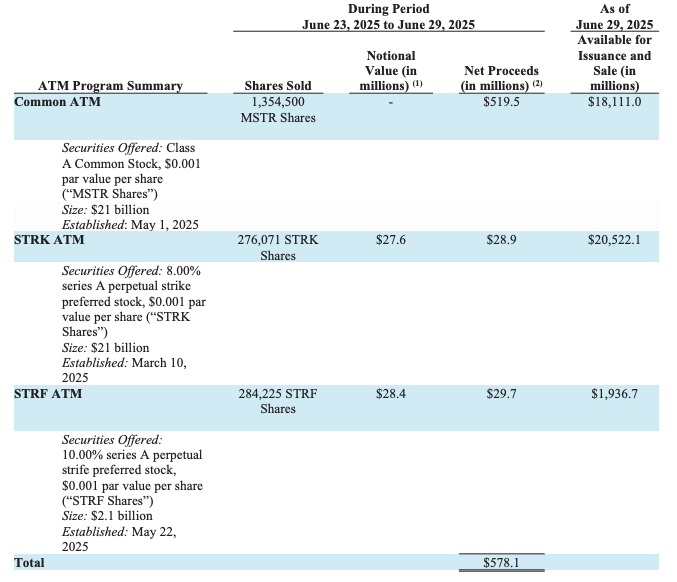

The purchase was funded by an equity raise from June 23–29, 2025, across its at-the-market (ATM) offering programs. The company sold 1,354,500 MSTR shares for $519.5 million in net proceeds, 276,071 STRK shares for $28.9 million, and 284,225 STRF shares for $29.7 million—totaling $578.1 million in funding for the week.

According to the filing, “The Bitcoin purchases were made using proceeds from the MSTR ATM, STRK ATM and STRF ATM.”

As of June 29, 2025, Strategy now holds 597,325 BTC acquired at a total cost of $42.4 billion, with an average purchase price of $70,982 per Bitcoin.

This acquisition follows last week’s June 23 filing where Strategy purchased 245 BTC for $26 million, bringing its total holdings to 592,345 BTC at the time. In that report, Strategy revealed a Bitcoin yield of 19.2% YTD and signaled a target of 25% for the year. With this latest update, the firm is making measurable progress toward that goal.

The June 30 report also confirms that Strategy declared quarterly cash dividends payable on both its STRK and STRF preferred shares—$2.00 and $2.64 per share, respectively—further emphasizing the firm’s expanding financial activity.

The company stated it “may continue to use proceeds from future sales of shares under its Common ATM for general corporate purposes, which may include payment of dividends on its preferred stock.”

This continued Bitcoin accumulation process by Strategy, remains the example and frontrunner as several other companies worldwide continue to adopt Bitcoin such as Anthony Pompliano’s ProCap, The Smarter Web Company, GameStop, and so many more. Even as markets face ongoing macroeconomic uncertainty, Strategy continues to show that Bitcoin is the answer and clarity to that uncertainty.

The company maintains a public dashboard at strategy.com for real-time updates on BTC holdings and share activity.

With BTC hovering around $107,000, Strategy’s long-term commitment to Bitcoin as a treasury asset remains one of the most bullish in corporate finance history.